The State of Malaysian Media Publisher Landscape

“The audience today do not read but BROWSE news!”

This was the key takeaway that I learned from a talk conducted by a content marketing specialist two years ago. It is noteworthy to find out the way how the audience today consumes the content due to the rise of digital media.

Indeed, it comes with no surprise to discover that digital media is the game changer in the marketing and advertising industry in most of the developing countries including Malaysia. Because of the change in consumer behaviour, the Malaysian media landscape has transformed drastically over the past few years.

The most significant changes are the shutdown of some of the traditional media publishers. One of them would be the announcement of Mongoose Publishing to close both Men’s Health and Women’s Health magazines in Malaysia in September 2017. Meanwhile, in 2018, the Mail, Malaysia’s oldest newspaper had decided to stop its print publication and go fully digital.

Besides, the shift of the media landscape has also led the five major online publishers in Malaysia including Media Prima Group, Star Media Group, Utusan Malaysia, MCIL and The Edge to sign a memorandum of understanding (MOU) to build a consortium called Malaysia Premium Publishers Marketplace (MPPM) with the objective to ensure transparency and delivery of high-quality online ads.

Why Are Traditional Publishers in Malaysia Going Digital?

Adapting to Changing Consumer Habits and Trends

According to a 2017 study done by Nielsen, 94% of Malaysian young adults aged between 15 to 24 years old consume both traditional and digital media. It also reveals that the online media enjoyed more than 70% weekly reach in 2017.

In addition, based on the latest 2018 report from Hootsuite and We are Social, 31% of the internet users said that the online media is the channel that first introduced them to a product or service that they subsequently purchased. As illustrated by this report, 26% of internet users use smartphones to check news whereas 14% of them read e-magazines using smartphones. This also explains why YMYL (Your Money or Your Life) pages are so popular in the digital era.

All these data show that the digital media continues to thrive in Malaysia while posing a significant challenge to the traditional, print media to stay ahead of the competition.

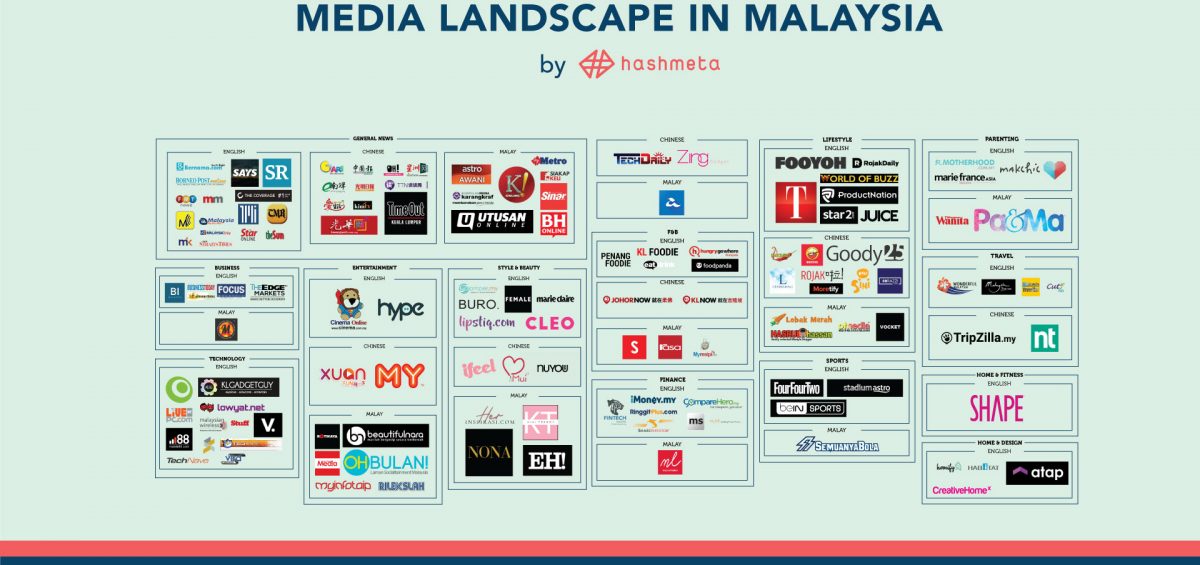

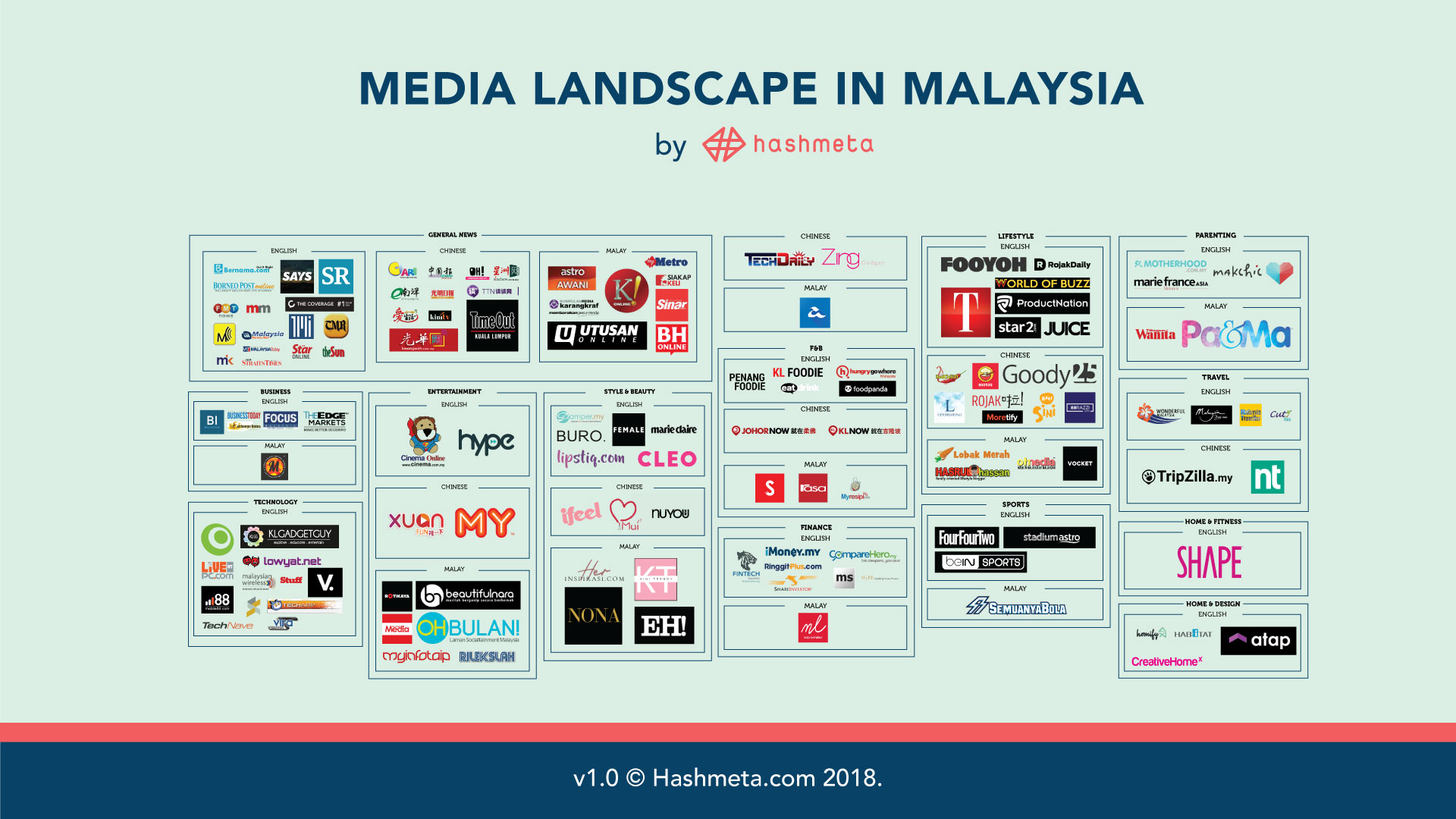

List of Popular, Emerging Digital Publishers in Malaysia

Below is a sampling of top digital publishers in Malaysia, sorted into their respective verticals:

General News

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Malaysiakini | >25 million | 1.5 million |

| The Star | >20 million | 1 million |

| Sinar Harian | >10 million | 3.4 million |

| My Metro | >9.5 million | 4.5 million |

| Free Malaysia Today | >9.5 million | 694,000 |

Lifestyle Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| TimeOut KL | >10 million | 100,000 |

| World of Buzz | >2 million | 730,000 |

| Goody25 | >1 million | 359,000 |

| Vocket | 1 million | 446,000 |

| Leesharing | 1 million | 364,000 |

Business Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| The Edge Markets | >1.5 million | 95,000 |

| Business Insider Malaysia | >350,000 | 27,000 |

| Focus Malaysia | >125,000 | 105,000 |

| Majalah Niaga | >70,000 | 170,000 |

Finance Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| IMoney.my | >850,000 | 221,000 |

| RinggitPlus.com | >800,000 | 257,000 |

| CompareHero | >400,000 | 30,000 |

| Majalah Labur | >190,000 | 73,000 |

| FintechNews Malaysia | >50,000 | <3,000 |

Style & Beauty Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Kini Trendy | >3 million | 644,000 |

| Female | >115,000 | 73,000 |

| Lipstiq | >90,000 | 101,000 |

| Buro 24/7 | >75,000 | 28,000 |

| Pamper.my | >45,000 | 99,000 |

Food & Beverage Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| RASA | >1 million | 584,000 |

| MyResipi | >1 million | 1 million |

| Openrice Malaysia | >350,000 | 474,000 |

| KL Foodie | >250,000 | 259,000 |

| HungryGoWhere | >200,000 | 200,000 |

Technology Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Lowyat.NET | >7.5 million | 213,000 |

| Stuff | >2.5 million | 100,000 |

| TechNave | >1.5 million | 205,000 |

| SoyaCincau | >1 million | 90,000 |

| Mobile88.com | >1 million | 205,000 |

Parenting Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Mingguan Wanita | >1 million | 1 million |

| Pa&Ma | >990,000 | 1.3 million |

| the Asian parent | >830,000 | 184,000 |

| Marie France Asia | >420,000 | 12,000 |

| Motherhood | >31,000 | 205,000 |

Entertainment Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Cinema Online | >3.5 million | 276,000 |

| Oh Bulan | >3 million | 2.3 million |

| ROTIKAYA | >2 million | 4.3 million |

| Beautiful Nara | >1.5 million | 1 million |

| Xuan | >350,000 | 185,000 |

Travel Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Tourism Malaysia | >175,000 | 3.3 million |

| Wonderful Malaysia | >150,000 | >2,500 |

| Cuti.my | >110,000 | 380,000 |

| Tripzilla MY | >50,000 | 713,000 |

| Next Trip | >35,000 | 76,000 |

Home & Design Publishers

| Publishers | Monthly Web Visits* | Facebook Likes^ (as of Dec 2018) |

| Homify | >110,000 | 11.8 million |

| atap | >25,000 | 224,000 |

| CreativeHomex | >28,000 | 56,000 |

| Habitat | >7,500 | 137,000 |

*Figures obtained from SimilarWeb for the root domains for the month of December. SimilarWeb “calculates a visit (Session) for a website if a visitor accesses one or more pages. Subsequent page views are included in the same visit until the user is inactive for more than 30 minutes. If a user becomes active again after 30 minutes, that counts as a new visit. A new session will also start at midnight.”

^Figures below 1 million are rounded off to the nearest thousand.

Tapping the Marketing Potential of the Digital Publisher in Malaysia

This mapping of the online publisher landscape in Malaysia sheds some light on the vast opportunities that both the B2B and B2C businesses and marketers can explore. Although the traditional media is still dominating the overall advertising spend in Malaysia, it is imperative for the marketers to work with the digital publishers in order to win the heart of the millennials who are turning more and more for online sources for information and entertainment.

Ad or content quality and relevance is always the recipe for success for any digital marketing campaigns. Instead of reaching out to the largest publishers, it is better than to choose the right digital publisher that enables you to have the right conversation with the right audience at the right time.

Finding the right publisher can be a daunting task and engaging a professional digital marketing agency that is familiar with the media publishing sector in Malaysia is what you need to save the hassle while hitting the result.