The media publishing industry in Singapore is experiencing a tsunami. Within the past 12 months, a number of local news publications (most notably Today) have announced that they will cease their print editions. However, this does not mean they are now out of print. Many traditional publications continue to exist, on our screens.

In May 2018, the Singapore Media Exchange (SMX) was officially born. It is a digital advertising marketplace launched by the country’s two traditional media powerhouses: Singapore Press Holdings (SPH) and Mediacorp. This joint venture promises a new option for marketers keen to reach large sections of the Singaporean audience.

Table of Contents

What Type of Marketing Are You Looking to Execute for 2019?

Why Are Traditional Publishers in Singapore Going Digital?

The Money is in Digital

Go back a decade and some can still dismiss the Internet as a passing fad. But with revenues rapidly dwindling for print news publications, and with Facebook and Google successfully turning their platforms into global advertising marketplaces, it is increasingly clear that the money is in digital.

SMX’s formation is a response to these established marketplaces and points to an irrevocable trend: Digitalization. To generate new revenue streams, businesses must leverage digital technologies and change their operating models.

To survive, all players have to reinvent their wheels.

Beyond the Singapore Media Exchange (SMX)

Opportunities are not limited to conventional publishing companies. For instance, Singapore Telecommunications (SingTel)—the largest telecommunications company in Southeast Asia—is also transforming itself into a digital media technology company. Here is an assessment of the new possibilities from SingTel’s CEO, Chua Sock Koong:

“Digitization has impacted our own industry, and the impact is so significant. But we look at other industries that have also been disrupted, and see if we can expand to that industry, leveraging our telco assets. We went into digital advertising and digital marketing, because while entertainment is increasingly moving to mobile, the advertising spending was still mainly in the traditional media, and we saw that as a very good opportunity. We have a large amount of data to use for digital advertising.”

Yet the expansion of digital technologies is only one half of the media evolution. The other half is consumer behaviour. Technologies count for nothing—at least for marketers—if consumers are not willing to adopt them in sizeable crowds.

The question for businesses and marketers alike is thus: Are Singaporean readers making the shift?

Adapting to Changing Consumer Habits

According to a 2016 study by YouGov, 50% of Singaporeans use the Internet as their main source of news, compared to 22% each for TV and print sources. This trend towards digital platforms is mirrored in 6 of the other 8 countries surveyed. The shift is more pronounced for the generation aged below 35, of which only 8% rely on print media as the main news source.

Social media dominates among digital platforms, with 58% using it for news and 24% using it as the main source of news. Nonetheless, a substantial proportion of Singaporeans continue to use the websites and apps of traditional publishers, from newspapers to news magazines to TV and radio companies.

While print media is staring into the sunset due to changing media consumption habits, not all is lost for traditional publishing companies. The formation of SMX reflects an awareness of the potential of their online publications.

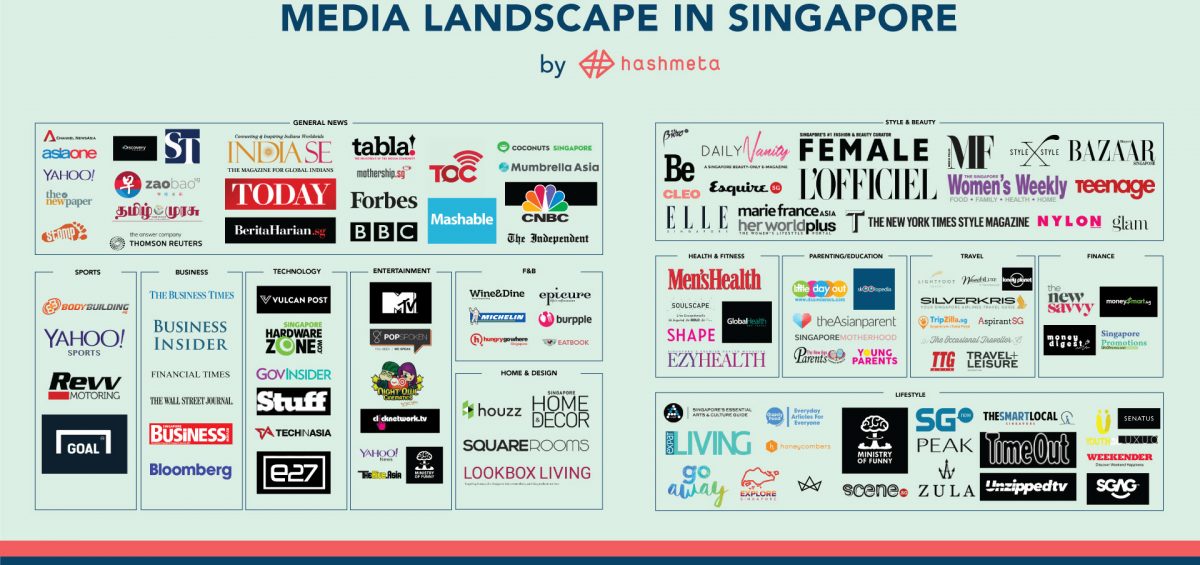

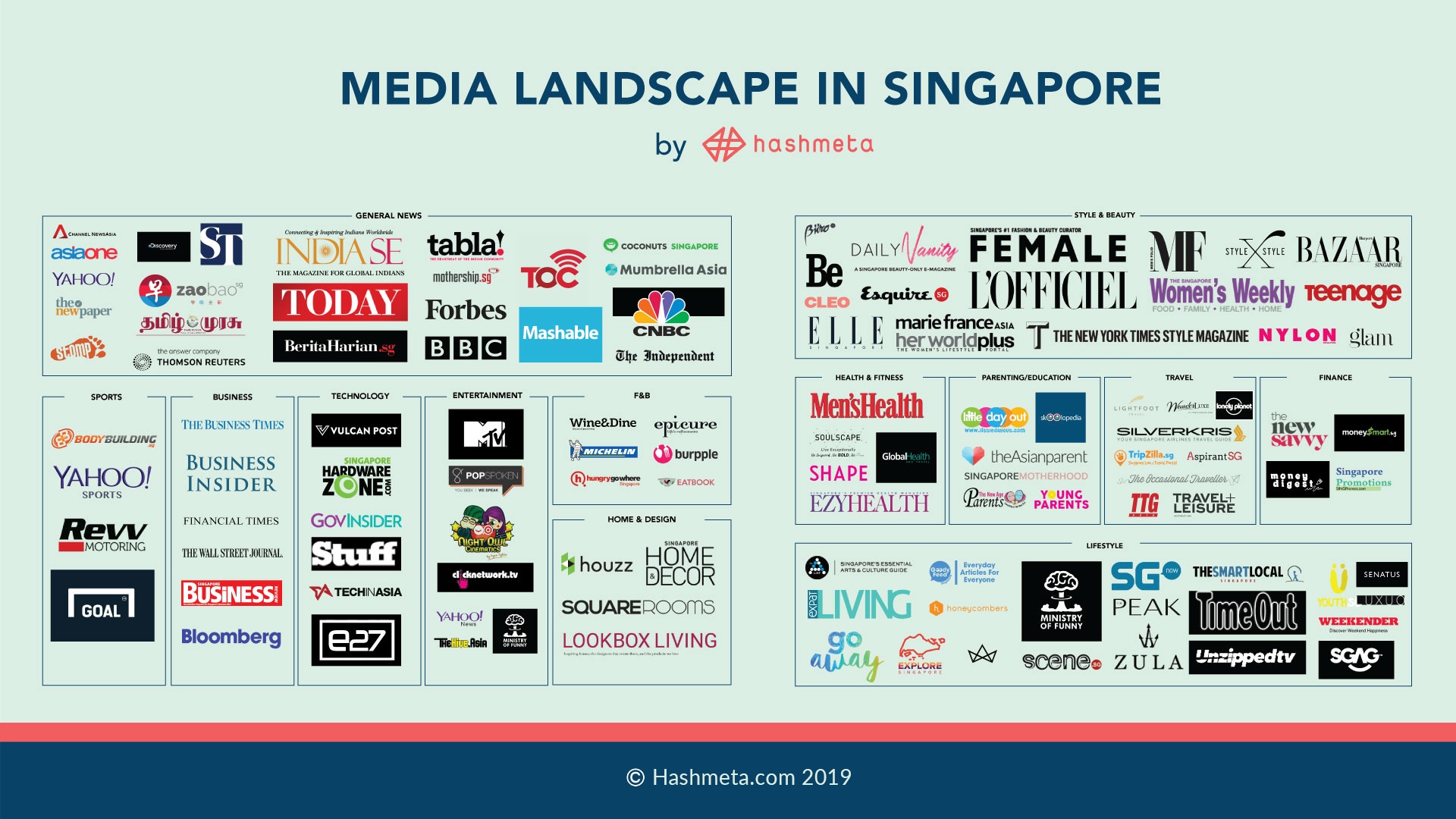

Indicative List of Digital Publishers in Singapore

However, SPH and Mediacorp will have to contend with a diverse range of competitors on the Internet. This is especially true of more specialised verticals, such as lifestyle and finance, where several digital magazines can lay claims to strong readership and influence.

Below is a sampling of top digital publishers in Singapore, sorted into their respective verticals:

News Media Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| Channel News Asia | >10 million | 2.6 million |

| The Straits Times | >10 million | 1.2 million |

| Today Online | >2.5 million | 733,000 |

| Mothership | >2.5 million | 243,000 |

| The Online Citizen | >1 million | 103,000 |

E.g. Click here to compare the keyword search volumes of publishers in the news vertical.

Lifestyle Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| TheSmartLocal | >1 million | 357,000 |

| GoodyFeed | >750,000 | 381,000 |

| The Honey Combers | >750,000 | 75,000 |

| SGAG | >50,000 | 832,000 |

| AList SG | >25,000 | 22,000 |

Home & Design Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| The Spruce | >250,000 | 15,000 |

| Home & Decor | >100,000 | 61,000 |

| Renonation | >100,000 | 86,000 |

| Houzz | >75,000 | 2.9 million |

| SquareRooms SG | <25,000 | 69,000 |

Style & Beauty Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| Her World Singapore | >750,000 | 75,000 |

| Daily Vanity | >250,000 | 34,000 |

| The Singapore Women’s Weekly | >100,000 | 20,000 |

| Teenage Singapore | >100,000 | 104,000 |

| Nylon SG | >100,000 | 141,000 |

Travel Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| Tripzilla Singapore | >750,000 | 513,000 |

| Aspirant SG | >50,000 | 42,000 |

| The Occasional Traveler | >50,000 | 1,700 |

| Lightfoot Travel | >25,000 | 11,000 |

| Wanderluxe – Theluxenomad | >25,000 | 80,000 |

Entertainment Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| MTV Asia | >250,000 | 1 million |

| Clicknetwork.tv | >100,000 | 57,000 |

| The Hive Asia | >25,000 | 86,000 |

| Night Owl Cinematics (NOC) | >25,000 | 120,000 |

| Popspoken | <25,000 | 12,000 |

F&B Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| Hungry Go Where | >1 million | 92,000 |

| Lady Iron Chef | >500,000 | 647,000 |

| Yelp | >500,000 | <1,000 |

| Eat Book | >250,000 | 136,000 |

| Miss Tam Chiak | >250,000 | 96,000 |

Technology Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| HardwareZone | >7.5 million | 119,000 |

| Tech In Asia | >1 million | 822,000 |

| Vulcan Post | >500,000 | 62,000 |

| e27 Singapore | >250,000 | 115,000 |

| NXT Singapore | <25,000 | 7,000 |

Business Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| Business Times | >1 million | 141,000 |

| Business Insider | >750,000 | 12,000 |

| Singapore Business Review | >100,000 | 17,000 |

| SG Investors | >100,000 | 5,000 |

| Eco Business | >100,000 | 5,000 |

Finance Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| MoneySmart | >1 million | 162,000 |

| Dollars & Sense | >500,000 | 25,000 |

| Money Digest | >250,000 | 131,000 |

| Dr Wealth | >100,000 | 13,000 |

| SG Money Matters | >25,000 | 1,000 |

Health & Fitness

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| Men’s Health | >500,000 | 47,000 |

| Shape | >100,000 | 27,000 |

| Body Building | >25,000 | 1,000 |

| Active8me | <25,000 | 24,000 |

| Yoga Journal SG | <25,000 | 2,000 |

Parenting / Education Publishers

| Monthly Web Visits* | Facebook Likes^ (as of Sep 2018) | |

| The Asian Parent | >500,000 | 518,000 |

| Kiasu Parents | >250,000 | 15,000 |

| Little Day Out | >100,000 | 14,000 |

| Honey Kids Asia | >100,000 | 57,000 |

| Skoolopedia | >41,000 | 7,000 |

*Figures obtained from SimilarWeb for the root domains for the month of August. SimilarWeb “calculates a visit (Session) for a website if a visitor accesses one or more pages. Subsequent page views are included in the same visit until the user is inactive for more than 30 minutes. If a user becomes active again after 30 minutes, that counts as a new visit. A new session will also start at midnight.”

^Figures below 1 million are rounded off to the nearest thousand.

Tapping the Marketing Potential in Singapore’s Publishers

This quick mapping of the digital publishers in Singapore provides evidence that opportunities abound for marketers. Although SPH and Mediacorp continue to dominate the local news vertical—demonstrating the potential of SMX—there exist plenty of digital magazines catering to Singaporean audiences with significant clout of their own, especially in more specialised verticals.

While we have used metrics to quantify the value of digital publishers, more is not always better. The quality and degree of fit between the publications’ audiences and your products and services also matter greatly. Rather than flocking to the largest publications, you may find smaller platforms more useful for meeting your specific marketing goals.

Identifying and reaching out to the right publishers in Singapore requires significant investments of time and effort. An agency with keen knowledge of the media publishing sector will provide you with the surfboard you need to ride the digital tsunami into a new horizon.