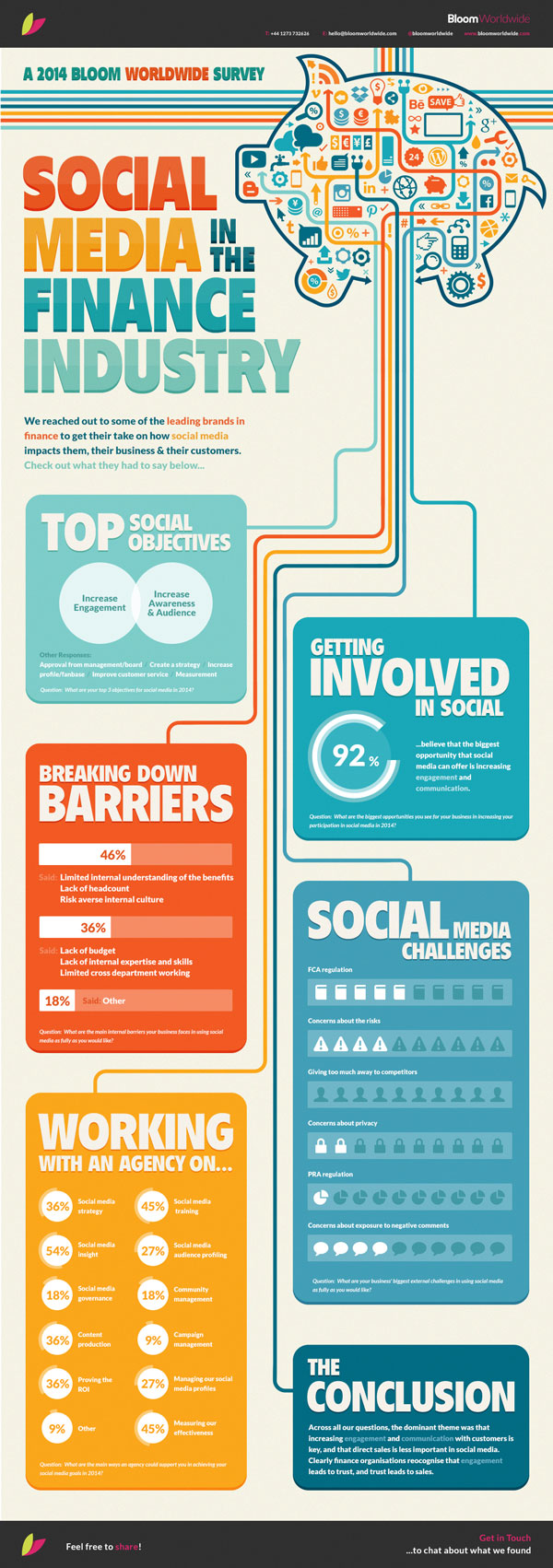

Above is a short introduction to social media in the financial industry. 92% of the brands interviewed believed that social media can help them. But the issue here is that 46% still didn’t really understand how they can use social media to their advantage. Company-wide education is important as the potential of social media only really shines when everyone in the company from the junior staffs to the CEO is onboard.

The financial industry has long been one that arms itself with complicated forms, countless miscellaneous fees, and industry jargons that makes it difficult for consumers to understand and digest its information.

For decades, consumers generally resign to the fact that financial products are by default complicated, and are simply not worth the trouble to scan through the multiple pages of legal speak to protect their own right.

But with the emergence of social media (Facebook, Twitter, Forums, Blogs), finally, there is a way to clarify this information easily.

Nowadays we can simply go to any financial forums/blogs available, or ask our friends over Facebook/Twitter for financial knowledge and advice. Together with the “Wisdom of Crowd” from the online community, suddenly information flow becomes so much more transparent and easily digestible.

As such, many financial institutions have started looking towards harnessing this change rather than seeing it as an obstacle. The opportunities and challenges for any financial services today lie in the creation of useful content.

So, let us take a look at some great examples of how certain financial companies from large to small make use of content marketing to their advantage, and what we can learn from them!

#1 Creating Content Customers Value

MoneySmart blogs on a variety of topics that looks at providing value for Singaporean from all walks of life.

They tackle their content topics from family, savings, travelling, health, education and marriage using only a single discussion point – finance. This helps MoneySmart to build authority, and a niche audience who cares enough about how to spend each and every cent wisely.

Not only that, they also help to simplify the process of comparing loans rates among various institutions easily through several self-select options.

And with all these information, whom do you think Singaporeans will turn to when they need any financial advice?

#2 Showing Your Expertise and Building Up Trust

Empire Global is a licensed money lending company in Singapore. In the past 2 years, Government were rolling out policies to regulate the private money lending industry in order to curb illegal money lending activities in Singapore.

Many aspiring entrepreneurs then decided to seize this opportunity to venture into the industry. This led to a high number of legal money lending companies sprouting up around Singapore.

With the increase in competition, many of these smaller finance institutes decided to turn to content marketing for sales leads.

In an attempt to break down the complexity of securing a personal loan, many have started blogging to answer commonly asked questions about the different loans products.

By providing sound financial advice on getting a loan to their audience, it helps to build trust and trustworthiness over the long run.

#3 Storytelling

Simple – Better Banking is an online bank that seeks to simplify the banking experience.

Being an online bank with no physical presence, Simple had to turn to content marketing to gain exposure and leads.

Simple’s employee maintains their blog by blogging about their own financial problems, experiences, and solutions. This is an excellent way, as people connect to stories and able to easily correlates back to their personal encounters. And by portraying a step-by-step journey on how to solve these problems, consumers are able to see how Simple can make an impact on their lives.

Through online and content marketing, Simple has gained the competitive advantages over their traditional competitions such as DBS Bank, whose CEO, Mr Piyush Gupta, recently says Mobility and Online Banking is redefining the industry.

Therefore, as seen from these examples, content marketing can help to break down the traditional barriers that consumers have built up for themselves over the years.

Most importantly, by creating targeted and legit content with the aim of helping your customers, you can build a trusting and long-lasting relationship with them.